DeFi Yield Farming

DISCLAIMER

Are you a Company?

Looking for marketing to grow your DeFi Project? That’s what we do here at Crowdcreate. We’re rated the #1 crypto marketing agency and have helped with some of the most successful companies in the world. Book a call with our team to learn more.

Are you an Investor or Fan?

Join our free network. You’ll get access to a private network of the top crypto investors, influencers, and thought leaders. You can also attend one of our free crypto & blockchain events.

Looking for marketing to grow your DeFi Project?

Introduction to DeFi

DeFi Yield Farming

What is Yield Farming?

DeFi Yield Farming Tools

Best DeFi Yield Aggregator

DeFi Yield Farming

Looking for marketing to grow your DeFi Project?

Best Yield Farming Tool Binance Smart Chain

Best Yield Farming Ethereum Tools

Looking for marketing to grow your DeFi Project?

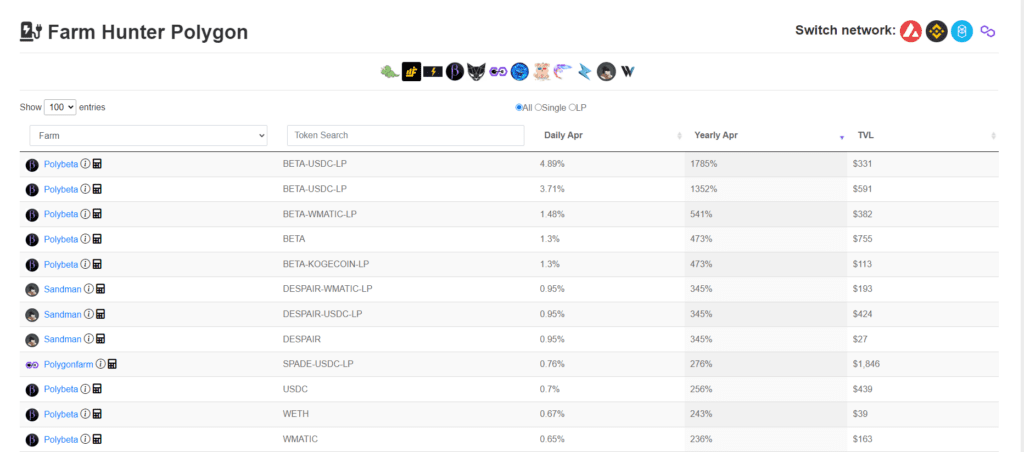

Best Yield Farming Polygon Tools

DeFi Yield Farming

Looking for marketing to grow your DeFi Project?

Best Yield Farming Tax Calculator

Where to Yield Farm?

Additional tools that aid you in DYOR are analysing its audits (a solid score is a must), whether the team is doxxed (not necessarily a major factor but is a sense of assurance) and using coin tracking sites like dexguru. Simply search a given token pair and press the “DYOR” button.

Best DeFi Yield Farm Tools: Honorable Mentions

TokenTax: TokenTax offers an impressive suite of services that make it as easy as possible to generate gains and losses associated with Cryptocurrencies. The best part is that it works for every country and not just for crypto but lacks as a full-fledged portfolio tracker.

CoinTracker: A hassle-free dashboard that automatically syncs your transactions from your account and calculator your taxes – CoinTracker does your work for you.

Crypto.com: Crypto.com’s very own Tax Calculator and is already a fan favourite of its users. Currently available for limited jurisdictions and boasts of a user-friendly interface that supports popular exchanges and wallets. The best part? It’s free for all crypto owners regardless if they have an account on Crypto.com’s exchange.

Looking for marketing to grow your DeFi Project?

Alternative Yield Farming Polygon Tools

Debank: An all in one dashboard for tracking your DeFi portfolio, providing a comprehensive overview of data and analytics from a wide variety of sources, AMMs, lending platforms and Blockchains. As of currently, it supports over 11 Blockchains and constantly expanding. The Yield Farming Tool also allows you to find the best swap prices for a given Crypto asset, therefore, allowing you to make the best of Decentralized Protocols.

ApeBoard: Also, a cross-chain DeFi dashboard and is similar to Cryptonuts (mentioned previously in this list). ApeBoard leans more towards established DeFi protocols hence you’ll find a more trusted overview of platforms here.

Zapper: A platform that claims to create the ultimate hub for Decentralized Finance whereby users can simply track their DeFi investments and asset management with a click of a button. Its most notable feature is that it saves you transaction fees by aggregating all of your individual transactions into a single consolidated transaction. Sweet, right?

Conclusion on Best DeFi Yield Farming Tools

If you have a DeFi Yield Farming Tool that you’d like to be featured on prominent Crypto websites or having influencers create hype around it, don’t hesitate to contact our team at Crowdcreate where we can help out with your marketing strategies.